Garrison Keillor didn’t much like the way in which some “burly” security men behaved during his trip to Texas last year, but this post indicates that security matters can get a bit out of hand even in such progressive outposts as Keillor’s beloved Minneapolis. A couple of Minneapolis’ finest apparently decided to arrest, rough up and Taser a citizen who had the audacity to attempt to ride home from the local airport on his bicycle. The bicyclist ended up spending 24 hours in jail before being released on a $2,000 bond. A trial, in which the bicyclist is apparently representing himself, is scheduled for mid-July. Stay tuned.

Garrison Keillor didn’t much like the way in which some “burly” security men behaved during his trip to Texas last year, but this post indicates that security matters can get a bit out of hand even in such progressive outposts as Keillor’s beloved Minneapolis. A couple of Minneapolis’ finest apparently decided to arrest, rough up and Taser a citizen who had the audacity to attempt to ride home from the local airport on his bicycle. The bicyclist ended up spending 24 hours in jail before being released on a $2,000 bond. A trial, in which the bicyclist is apparently representing himself, is scheduled for mid-July. Stay tuned.

Monthly Archives: June 2007

Help for J. Fred

Charles Kuffner passes along the news that J. Fred Duckett — the longtime public address announcer for Rice University sports teams, the Stros, the Oilers, the Houston Livestock Show and Rodeo, the Texas Relays and many other events — is battling leukemia and in need of blood platelet donations. Kuff’s post has the information on how to arrange a donation, as does this post from the Rice forum. Please give if you can and pass along the information to anyone who has enjoyed J. Fred’s good-natured style over the years (no one who ever heard it will forget J. Fred announcing at Stros games “Jose Cruuuuuuuuuuuuuuuuuuuuuuzzzz!”).

Charles Kuffner passes along the news that J. Fred Duckett — the longtime public address announcer for Rice University sports teams, the Stros, the Oilers, the Houston Livestock Show and Rodeo, the Texas Relays and many other events — is battling leukemia and in need of blood platelet donations. Kuff’s post has the information on how to arrange a donation, as does this post from the Rice forum. Please give if you can and pass along the information to anyone who has enjoyed J. Fred’s good-natured style over the years (no one who ever heard it will forget J. Fred announcing at Stros games “Jose Cruuuuuuuuuuuuuuuuuuuuuuzzzz!”).

Update: Sad news. J. Fred died on Monday, June 25. Charles Kuffner has more.

Fiddling while the Whole Foods-Wild Oats deal burns

Geoff Manne (see also here) and Thom Lambert (see also here) over at the Truth on the Market blog are having a field day bashing the misdirected FTC opposition of the Whole Foods-Wild Oats merger. And with good reason.

Geoff Manne (see also here) and Thom Lambert (see also here) over at the Truth on the Market blog are having a field day bashing the misdirected FTC opposition of the Whole Foods-Wild Oats merger. And with good reason.

The latest development in this bizarre episode of excessive governmental regulation is the publication of the unredacted version of the FTC’s complaint against the proposed merger, which relies heavily on comments that Whole Foods CEO John Mackey made to his board about the merits of the merger. Not surprisingly, Mackey told the Whole Foods board members the straight truth as to why it would be good for Whole Foods to acquire Wild Oats and, in do doing, pooh-poohed the ability of other supermarket chains to compete with Whole Foods. This David Kesmodel/WSJ($) article sums it up well:

The lawsuit quotes Mr. Mackey as saying that the company “isn’t primarily about organic foods” but “only one part of its highly successful business model,” citing as others “superior quality, superior service, superior perishable product, superior prepared foods, superior marketing, superior branding and superior store experience.”

What is wrong with that? All Mackey is saying is that other supermarkets are not currently a direct competitor of Whole Foods because they are focused on price rather than the Whole Foods shopping experience. But nothing is stopping those other chains from changing course and imitating the Whole Foods karma if it’s in the interest of their shareholders to do so. The FTC’s theory that Whole Foods is attempting to monopolize the “hip” grocery shopping experience borders on the absurd.

Mackey has fired back with his own blog post, which is well worth reading. Among other things, he points out that Whole Foods’ prices are unaffected by whether it is competing in a particular area with a Wild Oats store and that several other grocery chains are bigger and more direct competitors to Whole Foods than Wild Oats. Frankly, Mackey’s blog post would be an excellent affidavit in support of a summary judgment motion for Whole Foods and Wild Oats.

Wouldn’t it be interesting if Whole Foods could, through discovery, find out why the FTC is pursing this costly regulatory charade in the first place?

Want a season ticket? Take out a mortgage

Conde Nast’s Megan Barnett reports on how the lion’s share of the new Yankee Stadium is apparently going to be financed. The idea is that the seats in the new Yankees Stadium will be sold in advance to investors who will own them in perpetuity. Morgan Stanley and its partner, a start-up entity called Stadium Capital Financing Group, are hoping that their structure becomes the accepted way of privately-financing sports stadiums. They have even applied for a patent regarding the concept, which seems like a stretch. Here’s how it would work:

Conde Nast’s Megan Barnett reports on how the lion’s share of the new Yankee Stadium is apparently going to be financed. The idea is that the seats in the new Yankees Stadium will be sold in advance to investors who will own them in perpetuity. Morgan Stanley and its partner, a start-up entity called Stadium Capital Financing Group, are hoping that their structure becomes the accepted way of privately-financing sports stadiums. They have even applied for a patent regarding the concept, which seems like a stretch. Here’s how it would work:

Fans would buy seats for a designated period of time and finance them much like a mortgage. Pricing mechanisms can vary, but the most appealing option for buyers might be a 30-year loan with an annual payment equal to the current price of a season ticket. In exchange, the seat becomes real property, equivalent to, say, a condominium. The team (or university or other owner) receives the principal amount of the loan up front, to put toward construction costs.

This arrangement is different from seat licensing, which gives the holder the right to buy a season ticket for a specific seat. . . . Under [the] system, people own seats, not shares of a team.

Say, for instance, the current price of a season baseball ticket is $3,240. A 30-year loan at 6 percent interest with an annual payment of $3,240 results in a principal amount of $45,000. Even if the price of the seat doubles in the next 20 years, the seat owner still pays $3,240. Investors will have the option of making annual payments over 30 years, paying the entire amount up front, or something in between. Owners can also sell their seats at any time for market value, but rest assuredóthe team will get a cut of any profits.

At least one expert on financing stadiums, though, does not believe the financing technique will be all that earth shattering:

Roger Noll, a Stanford University economics professor who has written extensively about stadium financing, says that such an approach might make a dent in required public funding but will never replace it. Noll points out that most teams can’t afford to sacrifice future revenues in order to pay for their ball fields. “At the end of the day, stadiums are not good investments,” he says. “This isn’t going to be a revolution.”

H’mm, think this might work to defray the cost of this proposed boondoggle?

Saving for a boondoggle

Buried in this Chronicle article about increasing tolls on the Harris County toll roads and congestion on the Westpark Tollroad is the following nugget about yet another of the Metropolitan Transit Authority’s decisions that is contrary to its purpose of improving mobility in the Houston metro area:

Buried in this Chronicle article about increasing tolls on the Harris County toll roads and congestion on the Westpark Tollroad is the following nugget about yet another of the Metropolitan Transit Authority’s decisions that is contrary to its purpose of improving mobility in the Houston metro area:

Six months after the four-lane Westpark Tollway opened in 2004, traffic backups began occurring in certain areas, said Peter Key, toll road authority deputy director. Congestion has worsened since then.

The toll road authority would have preferred building a six- or even eight-lane tollway, Key said. The Metropolitan Transportation Authority, which owned the land in the area, was willing to sell only enough for a four-lane tollway, he said. Metro wanted to keep the remaining land in case it builds a commuter rail line along the tollway, Key said.

Metro vice president John Sedlak said Metro has considered using the corridor for rail for several decades and may build a light rail line along parts of the corridor, from the Hillcroft Transit Center to an undetermined distance east of the West Loop.

As noted in this previous post, Metro’s bias in favor of inefficient rail lines is a costly bet for Houstonians. Those who are driving the Westpark Tollroad on a daily basis are finding out that such costs far exceed even the formidable expense of building inefficient rail lines.

Why is Richard Justice analyzing sports?

One of the many curious aspects about the Houston Chronicle is that the local newspaper employs Richard Justice as a sports reporter and columnist. We already know that he has trouble evaluating baseball (see also here) and football. So, today Justice nails the trifecta of incompentence in evaluating Houston’s major sports teams with this post about Houston Rockets assistant general manager Dennis Lindsey’s decision to leave the Rockets to join the San Antonio Spurs front office:

One of the many curious aspects about the Houston Chronicle is that the local newspaper employs Richard Justice as a sports reporter and columnist. We already know that he has trouble evaluating baseball (see also here) and football. So, today Justice nails the trifecta of incompentence in evaluating Houston’s major sports teams with this post about Houston Rockets assistant general manager Dennis Lindsey’s decision to leave the Rockets to join the San Antonio Spurs front office:

The San Antonio Spurs have the NBA’s smartest front office. The hiring of Dennis Lindsey reenforces that notion. This is a tough loss for the Rockets, a very tough loss. He was excellent at what he did. Carroll Dawson had groomed him to be his successor, but Clueless Les went for Daryl Morey.

Who is calling who “clueless?” As noted in this post from almost three years ago, the Rockets have been mismanaged for a long time. The club has not won a playoff series over the past decade, one of the few NBA teams to hold that distinction. With the exception of Yao Ming, the Rockets’ draft picks over that period have been generally mediocre or poor. As a result, the Rockets have gone from being one of the top NBA teams playing in a sold out arena to the third best NBA team in Texas with an arena that often resembles an expensive mausoleum. Although Lindsey is certainly not responsible for all of that decline, his tenure with the Rockets coincided with that downturn.

So, owner Rockets Les Alexander went outside the organization to hire a new general manager. That hire may or may not work out, but it was certainly an understandable decision. Nothing that the Rockets have accomplished during Lindsey’s tenure with the club merited that Alexander simply hand him the job. That Lindsey is apparently cordial to Justice — as was former Stros GM Gerry Hunsicker — doesn’t justify Justice simply ignoring the facts.

How Not to use PowerPoint

Comedian Don McMillan nails it in this hilarious video. It’s a must view for anyone who has ever endured a bad PowerPoint presentation (is there anyone left who has not?). Hat tip to Craig Newmark.

Comedian Don McMillan nails it in this hilarious video. It’s a must view for anyone who has ever endured a bad PowerPoint presentation (is there anyone left who has not?). Hat tip to Craig Newmark.

Meanwhile, the WSJ’s ($) technology columnist Lee Gomes takes a look at the status of PowerPoint on its 20th (!) birthday.

All about Angel

No, we’re not back in the 1960’s when pro golfers regularly puffed cigarettes on television under the stress of tournament competition. That’s new U.S. Open champion Angel Cabrera of Argentina on the left enjoying a quick smoke with his caddie this past Sunday. Golf Digest’s Jaime Diaz provides this timely and excellent profile of Cabrera, which includes this observation about Cabrera by longtime Houston golf professional, Charlie Epps:

No, we’re not back in the 1960’s when pro golfers regularly puffed cigarettes on television under the stress of tournament competition. That’s new U.S. Open champion Angel Cabrera of Argentina on the left enjoying a quick smoke with his caddie this past Sunday. Golf Digest’s Jaime Diaz provides this timely and excellent profile of Cabrera, which includes this observation about Cabrera by longtime Houston golf professional, Charlie Epps:

Charlie Epps, a Houston-based teaching professional who lived in the small Argentine city of Villa Allende in the 1980s and met Cabrera when he was as a young caddie at the Cordoba GC, believes that Cabrera’s problems with keeping his composure stem from a deep-seated anger rooted in growing up in an impoverished broken home. “I remember that when he started playing he really had a temper–he just couldn’t handle bad shots–and that hurt him as a tournament player for a long time,” says Epps. “He’s a wonderful guy who had a lot of issues because of a very tough childhood, and with time he’s learned to overcome the them”

Meanwhile, Stu Mulligan over at the Waggle Room passes along more information about Cabrera in this interview with longtime Champions Tour pro Eduardo Romero, who is also from Argentina and is one of Cabrera’s sponsors.

Although not well-known outside of golf circles until this past weekend, Cabrera has long had a serious golf game. He is one of the Tour’s longest hitters and an excellent ball-striker. A balky putter has been what has kept him from being a regular winner on the Tour. He sunk a few putts this past weekend and it was enough for him to take home his first major tournament trophy. As with late-bloomer Lee Trevino a generation ago, it may well not be Cabrera’s last.

Summing up Oakmont

So, Phil Mickelson is probably not going to be able to play any tournaments for the next three weeks in preparation for next month’s British Open because of the injury to his wrist that he injured while hitting out of the absurdly dense rough at Oakmont Country Club for last weekend’s U.S. Open. Lawrence Donegan sums up how the the United States Golf Association can even screw up a nice story such as Angel Cabrera winning the U.S. Open:

So, Phil Mickelson is probably not going to be able to play any tournaments for the next three weeks in preparation for next month’s British Open because of the injury to his wrist that he injured while hitting out of the absurdly dense rough at Oakmont Country Club for last weekend’s U.S. Open. Lawrence Donegan sums up how the the United States Golf Association can even screw up a nice story such as Angel Cabrera winning the U.S. Open:

But in the midst of a spirit-lifting triumph for the underdog there was also something of a travesty for the game itself as once again the organisers of this historic tournament laid out a course that bordered on farce. It takes some doing to engender sympathy for golf’s pampered millionaires but the USGA somehow managed to do exactly that.

In my view, the U.S. Open is easily the least enjoyable of all of the major golf tournaments and frankly not as much fun to watch as The Players or any number of mid-major tournaments. Perhaps having a few of the top players elect not to play in the U.S. Open because of injury risk might be what it takes to get through to the U.S.G.A. Their obsession with tricking up golf courses already elevates luck over skill in determining a champion. Now, it has become downright dangerous for the participants. And for those who think that a wrist injury is not all that serious for a professional golfer, remember what such an injury did to the once-bright playing career of former University of Houston golfer and two-time NCAA champion Billy Ray Brown.

The Next Business Prosecution

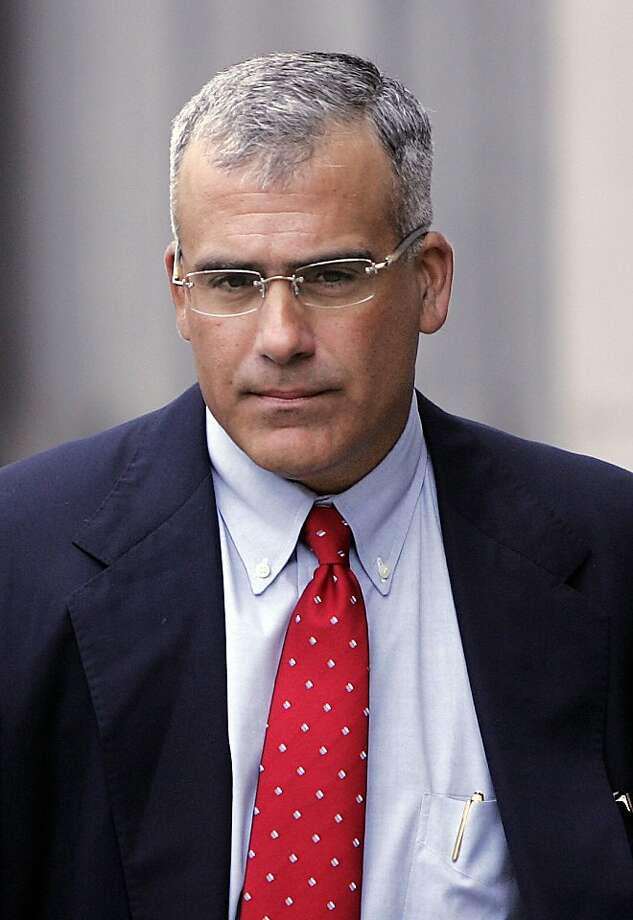

With the Conrad Black trial winding down in Chicago, it’s about time for another dubious prosecution of a businessman, this time former Brocade CEO Greg Reyes, who is the first executive to be prosecuted for fraud in connection with backdating stock options.

With the Conrad Black trial winding down in Chicago, it’s about time for another dubious prosecution of a businessman, this time former Brocade CEO Greg Reyes, who is the first executive to be prosecuted for fraud in connection with backdating stock options.

Larry Ribstein has been following the case since the start and has excellent analysis of the selective nature of the prosecution.

Here is Steve Stecklow’s WSJ article on the trial.

Given the widespread nature of backdating, there are probably more criminal defense attorneys watching this trial than any other single prosecution of a businessperson over the the past five years. If a blogger pops up to cover the trial, I’ll pass it along.