The Houston professional community and the Medical Center was abuzz yesterday with Baylor College of Medicine’s announcement late this week that the school will construct a new teaching hospital in the Texas Medical Center and end its recent affiliation with St. Luke’s Episcopal Hospital as its primary teaching hospital. This move comes only a couple of years after Baylor (which has no affiliation with Baylor University in Waco) terminated its longstanding with the Methodist Hospital as its primary teaching facility (previous posts here), a relationship that was as storied as the Medical Center itself. As usual, the Chronicle’s Todd Ackerman — who has done a superlative job in covering the Baylor-Methodist split and the changing nature of Baylor within the Medical Center — has this excellent report on the development.

The Houston professional community and the Medical Center was abuzz yesterday with Baylor College of Medicine’s announcement late this week that the school will construct a new teaching hospital in the Texas Medical Center and end its recent affiliation with St. Luke’s Episcopal Hospital as its primary teaching hospital. This move comes only a couple of years after Baylor (which has no affiliation with Baylor University in Waco) terminated its longstanding with the Methodist Hospital as its primary teaching facility (previous posts here), a relationship that was as storied as the Medical Center itself. As usual, the Chronicle’s Todd Ackerman — who has done a superlative job in covering the Baylor-Methodist split and the changing nature of Baylor within the Medical Center — has this excellent report on the development.

Baylor’s new hospital will resolve Baylor’s increasing concern over being the nation’s only top-20 medical school that does not own a hospital or whose department chairs do not head the key medical departments at an affiliated teaching hospital. The announcement is really not a surprise as there have been rumors for the past six months or so that Baylor-St. Luke’s partnership was on the rocks. Although the two institutions entered into merger negotiations shortly after they entered into the teaching hospital affiliation, those negotiations didn’t go anywhere as St. Luke’s staked a vision of providing medical services in new hospitals throughout the far-flung Houston metropolitan area. The straw that broke the camel’s back was St. Luke’s dragging its feet in making Baylor department chairs the head of the hospital’s parallel medical departments.

The demise of Baylor’s relationships with both Methodist and St. Luke’s is a reflection of the difficulties involved in sustaining long-term business and professional relationships in the face of the fast-changing world of American health care finance. When those pressures overwhelm a productive relationship such as the one that Baylor and Methodist long-enjoyed, the risk increases that a decline in the quality of medical care will be the ultimate result, which is a risk that should concern all of us. On the other hand, Baylor is presenting an ambitious plan for maintaining its position as one of the top medical schools in the country, and more competition between outstanding hospital facilities in one of the nation’s top medical centers could well generate even better medical care and research. How it turns out will reflect much in regard to the direction of the American health-care finance system and the challenges of training physicians within that changing system.

Monthly Archives: September 2006

One of the risks of the modern church

It’s trendy these days for megachurches to provide all sorts of special services for their members. One of the most popular of such services is marriage counseling, which this NY Times article reports placed a Texas church squarely in the crosshairs of a defamation lawsuit when the minister providing the service went and blabbed confidential information about one of the church members to the church elders.

It’s trendy these days for megachurches to provide all sorts of special services for their members. One of the most popular of such services is marriage counseling, which this NY Times article reports placed a Texas church squarely in the crosshairs of a defamation lawsuit when the minister providing the service went and blabbed confidential information about one of the church members to the church elders.

The leaders of the churches providing these services better recognize that such lawsuits are part of the risk of providing such a service and that it is not at all clear that the traditional separation between church and state is going to insulate the church from liability. Pastors who are leading their churches down this course need to ask themselves how their flocks will react when the church must raise money to pay a damages award from such a lawsuit or even just to pay the considerable cost of defending one. That’s not the type of sacrificial atonement that Christ had in mind.

Speaking of risks for megachurches, Victoria Osteen — wife of Lakewood Church’s Joel Osteen — has resolved her little Christmas season snit with the FAA, but that apparently is not the end of the story:

The Federal Aviation Administration has fined Victoria Osteen, wife of Lakewood pastor Joel Osteen, $3,000 after determining she had interfered with a Continental Airlines crew member aboard a flight late last year.

And this week, a flight attendant filed suit claiming she was assaulted by Victoria Osteen during that flight to Vail, Colo., for the Christmas holidays.

Osteen has paid the penalty, which is not an admission of guilt

Mrs. Osteen is well-represented by none other than the ubiquitous Rusty Hardin.

The most uncomfortable place right now in the United States?

Answer: The St. Louis Cardinals clubhouse.

Answer: The St. Louis Cardinals clubhouse.

Let’s put this in perspective. 10 days ago, the Cardinals won their game that day and the Stros lost theirs. At that time, the Cards were 79-69 and the Stros were 72-77. The Stros were trailing the Redbirds by a seemingly insurmountable 8.5 games.

After completing a sweep of the Pirates yesterday afternoon, the Stros are now 81-78 and a mere half game behind the 81- 77 Cards, who got creamed by the Brewers last night. So, in a week and a half, the Stros have gone from less than a five percent chance of making the playoffs to being a legitimate contender. You gotta love baseball.

Although there is a element of luck in what has happened, it’s really not that surprising when you look at the statistics. The Stros stellar pitching has continued to improve — as it usually does over the 2nd half of the season — and the hitting, although still well below Naitional League average, has improved enough so as not to undermine the excellent pitching. On the other hand, the Cardinals’ pitching — which has been deteriorating for over a season now — has gone into the tank while their hitting has been pretty much relegated to an occasional Pujols tater.

The Stros have three games against the Braves in Atlanta and the Cards have three more games at home against the Brewers and a make-up game, if necessary, against the Giants on Monday in St. Louis. If the Stros and Cards tie, the one-game playoff is on Tuesday at Minute Maid Park in Houston.

Ryder Cup post-mortem

John Huggan is the European correspondent for both Golf Digest and Golf World magazines, and his thoughts on the just-concluded Ryder Cup matches addresses the rather embarrassing question of whether the U.S. team has fallen so far behind the European squad that the U.S. should consider making their team “the Americas” team:

John Huggan is the European correspondent for both Golf Digest and Golf World magazines, and his thoughts on the just-concluded Ryder Cup matches addresses the rather embarrassing question of whether the U.S. team has fallen so far behind the European squad that the U.S. should consider making their team “the Americas” team:

[O]ne has to wonder what Jack Nicklaus was thinking as he surveyed from afar the carnage that was America’s Team. Was he musing the possibility of the hapless US side being bolstered by the likes of Canada’s Mike Weir, Angel Cabrera of Argentina and Columbian Camilio Villegas in a newly constituted ‘Americas’ team? To even suggest such a thing can no longer be dismissed as frivolous or mere mischief making. After two successive nine-point shellackings that hardly bode well for the new world’s prospects at Valhalla two years hence, it is a question that brings with it a growing legitimacy.

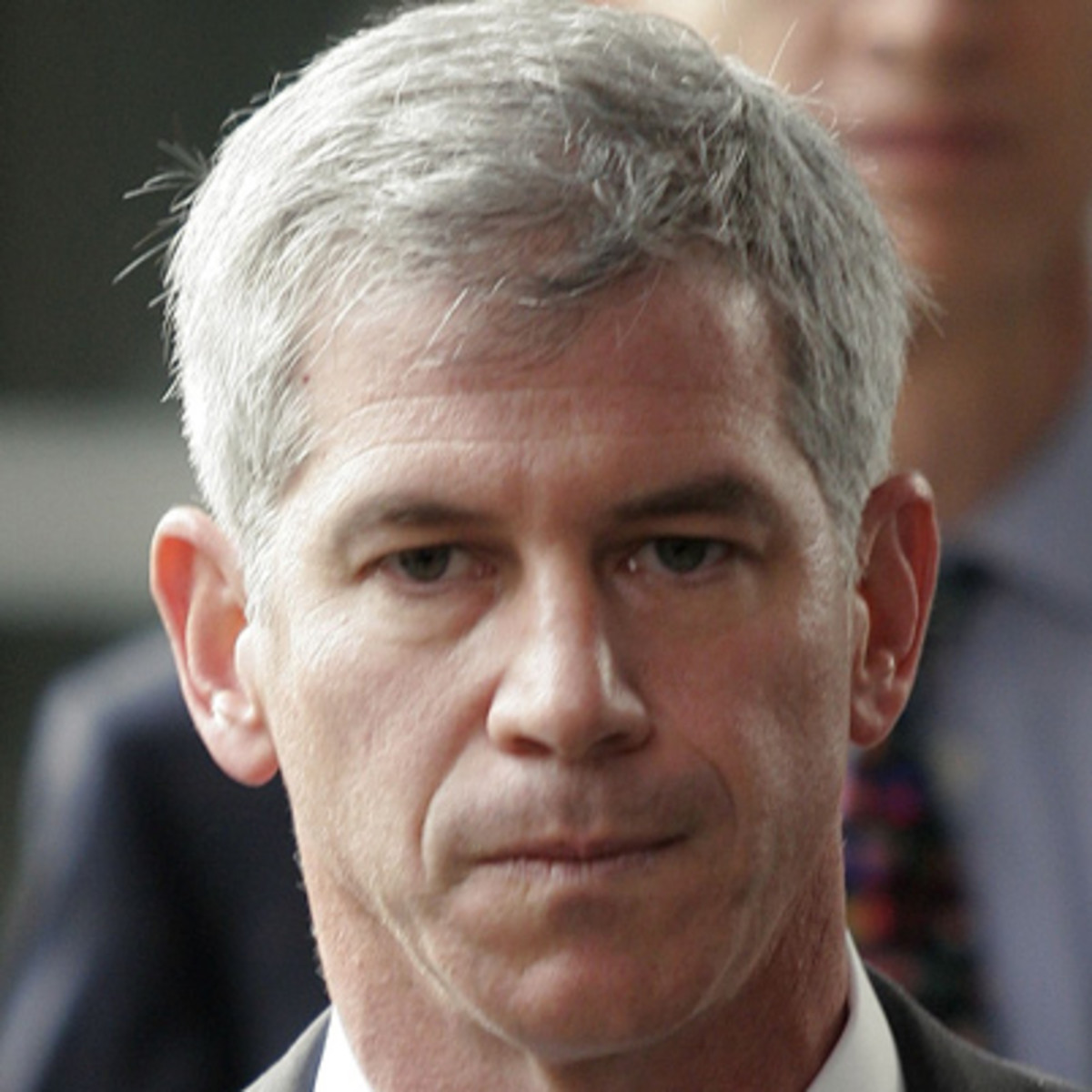

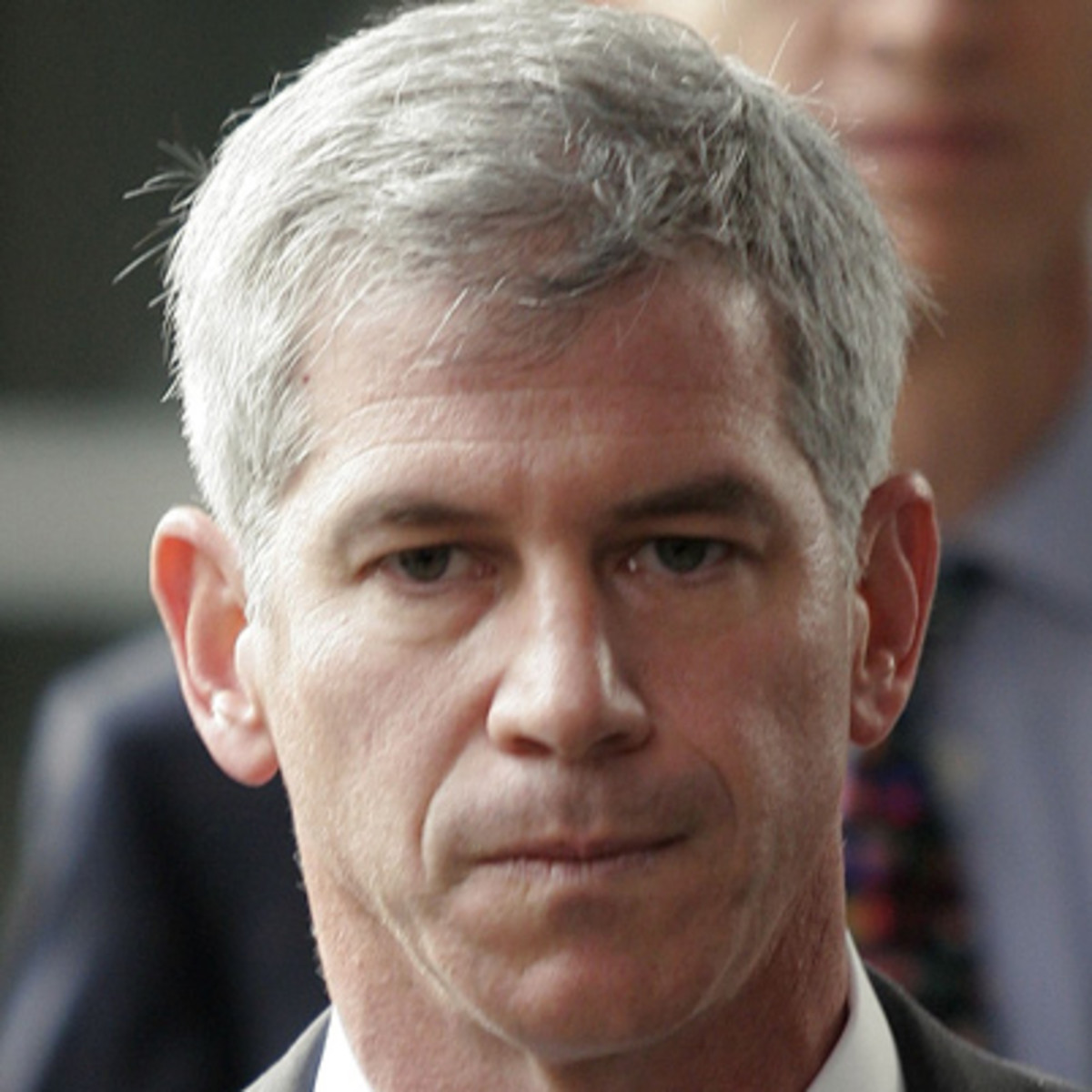

The Surprising Fastow Sentence

This Kristin Hays-Tom Fowler/Chronicle article picks up on an aspect of the six-year sentence assessed to former Enron CFO Andrew Fastow earlier this week that has largely been ignored in the media but noted earlier here.

This Kristin Hays-Tom Fowler/Chronicle article picks up on an aspect of the six-year sentence assessed to former Enron CFO Andrew Fastow earlier this week that has largely been ignored in the media but noted earlier here.

The Enron Task Force elicited testimony from Fastow during the Lay-Skilling trial that represented to the jury that Fastow was a more credible witness because he had agreed to a minimum ten-year prison sentence and, thus, had no incentive to lie.

As we know now, Fastow had not really agreed to anything of the sort and, in fact, successfully petitioned U.S. District Judge Ken Hoyt for a lighter sentence. The article quotes several experts — including former Enron Task Force director Andrew Weissmann — who express surprise that the Task Force did not attempt to require Fastow to serve a minimum of ten years.

Although interesting, the article fails to address the most troubling aspect of the Fastow sentencing hearing — that is, the apparent failure of any of the attorneys involved to inform Judge Hoyt about how the Lay-Skilling jury was misled by Fastow’s testimony.

When Judge Hoyt finds out about that he was not informed about that, my sense is that he is not going to be pleased.

The public reaction to the Fastow sentence has been fascinating and reflects the dubious nature of the Justice Department’s regulation of business-through-criminalization policy.

Viewed in a vacuum, the Fastow sentence is reasonably fair. Fastow effectively embezzled millions from Enron and ruined the careers of several other Enron executives who he induced to participate in the embezzlement. Six years is a harsh sentence, so Fastow is certainly not getting off lightly.

However, the Fastow sentence was not handed down in a vacuum.

Not only did Fastow and the Task Force prosecutors mislead the jury in order to convict Lay and Skilling, they trampled justice by needlessly ruining the careers of the four Merrill Lynch executives in the Nigerian Barge case and they are currently doing the same thing to the three U.K. bankers in the NatWest Three case.

There is simply no way to reconcile Fastow’s sentence with the six-year sentence handed down to Jamie Olis — who did not steal anything and refused to tell lies about others — or the seven-year sentence of former Enron chief accountant Richard Causey, who also did not steal anything and who has not testified against anybody.

The death of Ken Lay from defending himself against a weak and unjust case, as well as the effective life sentence likely faced by Jeff Skilling, further underscore the confusing message conveyed by the Fastow sentence.

As Larry Ribstein has repeatedly observed, criminal cases involving business executives have become a sort of lottery, incrementally undermining the principles of justice and respect for the rule of law upon which the success of American society is largely based.

If we lose respect for those principles, then “do you really think you could stand upright in the winds [of abusive state power] that would blow then?

Stros’ streak continues; Cards’ streak ends

As noted earlier here and here, the past week and a half has been fun for the Stros as an improbable series of events has catapulted the club back into playoff contention. The Stros won again in Pittsburgh last night, using nine pitchers for the second time in three games and overcoming a 6-1 deficit. The Stros (80-78) have now won eight straight games.

As noted earlier here and here, the past week and a half has been fun for the Stros as an improbable series of events has catapulted the club back into playoff contention. The Stros won again in Pittsburgh last night, using nine pitchers for the second time in three games and overcoming a 6-1 deficit. The Stros (80-78) have now won eight straight games.

Unfortunately, the Cardinals (81-76) finally broke their seven game losing streak, which is what really got the Stros back in the race for a playoff spot. Accordingly, the Cards’ magic number to win the NL Central title is now four — that is, any combination of further Cardinal wins (they have five games left) and Stros losses (they have four games left) equaling four means that the Cardinals win the title.

Roy O and the Stros go for the sweep this afternoon against the Pirates while the Cardinals open up a four game series at home tonight against the Brewers.

Mayor Bloomberg, save your money

This short WSJ ($) article left me shaking my head:

This short WSJ ($) article left me shaking my head:

New York City Mayor Michael Bloomberg appointed consulting firm McKinsey & Co. yesterday to examine why more international companies are choosing to raise money outside of New York.

The two-month, $600,000 study comes as many of the largest initial stock offerings bypass a listing with NYSE Group Inc. and Nasdaq Stock Market Inc. for listings in London or in their home markets. Mr. Bloomberg and Sen. Charles Schumer (D., N.Y.) will review the results in an effort to improve New York’s position as a financial center.

Many big international IPOs no longer want to have their shares listed on a Western stock market, in part because they want local investors or because big international investment firms can often buy the stock even if its not listed in New York. Out of the top 25 global IPOs in each of the last two years, London snagged 11 listings, Hong Kong picked up six and New York received four, according to recent data.

Regulation costs, legal risks and increased white-collar-crime enforcement also get a lot of attention. The four-year-old U.S. Sarbanes-Oxley accounting-and-governance law has made it more expensive for companies, especially smaller ones, to list.

Investment-bank underwriting fees are also substantially lower in London — 3% to 4% of IPO receipts, compared with 6.5% to 7% in the U.S., according to a June report commissioned by the City of London.

Yesterday, at a private-equity conference in New York sponsored by Dow Jones & Co., Nasdaq Chief Executive Bob Greifeld said he couldn’t think of a reason for the difference in the IPO fees and predicted that there would be more pricing pressure on U.S. underwriting fees in coming years.

Mayor Bloomberg should save his city’s money. For the answer to the question posed, all the Mayor needs to do is talk to his state’s future governor and examine this mindset, which the future governor embraces. That mindset leads to abominations such as this and this, which business owners tend to notice after awhile. Indeed, the proponents of such dubious policies are widely-publicizing them to the international business community.

All of this has already contributed greatly to U.S. public companies and executive talent fleeing in droves to private equity. Why on earth would any international company choose to raise public money in such an environment?

Byron Nelson, R.I.P.

Golf’s quintessential gentleman — Byron Nelson — died yesterday in his home near Dallas at the age of 94. Here are the Dallas Morning News, the NY Times, and the LA Times obituaries, along with a PGATour.com timeline of Nelson’s life, a list of his records, and a handy summary of his career.

Golf’s quintessential gentleman — Byron Nelson — died yesterday in his home near Dallas at the age of 94. Here are the Dallas Morning News, the NY Times, and the LA Times obituaries, along with a PGATour.com timeline of Nelson’s life, a list of his records, and a handy summary of his career.

Nelson — who was affectionately known as “Lord Byron” — was a contemporary of his fellow Texan Ben Hogan, and was more successful on the PGA Tour than Hogan during the time that Nelson played (Hogan struggled on the Tour until he perfected his swing in his mid-30’s, by which time Nelson had retired). Nelson established one of the most remarkable records in sports history when he won 11 consecutive pro golf tournaments in 1945 (Dan Jenkins contends that it was actually 13 straight), a record — similar to Joe DiMaggio’s 56-game hitting streak in baseball — that will likely never be broken. Nelson won an incredible 18 tournaments that year and 52 (including five major tournaments) over his relatively short 16 year career on the Tour. He retired in 1946 from full-time competitive golf at the age of 34 after achieving his goal of earning enough money to buy a ranch in his beloved Texas.

Nelson was a kind and gentle man who remained active until his death. He set a wonderful example for all of us and represented much of what makes golf such an endearing pastime. He will be sorely missed (particularly by Dallas’ PGA Tour event) for many reasons, not the least of which was his perspective on how fortunate the modern PGA Tour players are:

“I only won $182,000 in my whole life,” said Nelson in a 1997 interview. “In 1937, I got fifth-place money at the British Open — $187 — and it cost me $3,000 to play because I had to take a one-month leave of absence from my club job to go.”

This is getting very interesting

The Stros beat the Pirates last night while the Cardinals behind their ace Carpenter lost again to the Padres. The Stros’ (79-78) winning streak is now seven, the Cardinals’ (80-76) losing streak is seven, and the Stros have pulled to within 1.5 games of the NL Central lead with five games to go.

The Stros beat the Pirates last night while the Cardinals behind their ace Carpenter lost again to the Padres. The Stros’ (79-78) winning streak is now seven, the Cardinals’ (80-76) losing streak is seven, and the Stros have pulled to within 1.5 games of the NL Central lead with five games to go.

If the Stros win three of those five games (two more against the Pirates and three against the Braves), then the Cardinals can still pull it out by winning just 3 of their final six games (one more against the Pads, four against the Brewers, and a make-up game against the Giants, if necessary). So, the Stros are still a longshot to win the division (the Stros are out of the race for the NL Wildcard playoff spot). But it’s sure refreshing to watch the Cardinals sweating this one out. The ghost of the 1964 Phillies — who blew a 6.5 game lead for the National League title by losing 10 of their final 12 games — is looming large over the Redbirds right now.

If the Stros and Cards end up tied for the NL Central title, then there will be a one-game playoff at Minute Maid Park next Tuesday.

More on the Fastow Sentence

It’s a good thing that Andy Fastow’s counsel did not mention Fastow’s following testimony on March 8 in the Lay-Skilling trial during Fastow’s sentencing hearing today in front of U.S. District Judge Kenneth Hoyt:

It’s a good thing that Andy Fastow’s counsel did not mention Fastow’s following testimony on March 8 in the Lay-Skilling trial during Fastow’s sentencing hearing today in front of U.S. District Judge Kenneth Hoyt:

Q. Does the government decide your sentence?

A. My Judge decides the sentence.

Q. And who is your Judge?

A. Judge Hoyt.

Q. Is that right here in Houston, in this courthouse?

A. Yes.

Q. Do you recall the maximum sentence that you could be sentenced to for these crimes?

A. For the crimes I’ve pled guilty to?

Q. Yes.

A. Yes. Ten years.

Q. And was there a minimum sentence that you pleaded guilty to?

A. My plea agreement states that I agree to a sentence of 10 years. [. . .]

Q. And in agreeing — in addition to agreeing to serving 10 years in prison, did you also have to forfeit moneys?

A. Yes.

The foregoing testimony was elicted on direct examination of Fastow by Enron Task Force prosecutor John Hueston for the purpose of representing to the Lay-Skilling jury that Fastow’s testimony was credible because he had agreed to a floor of ten years of prison time. On March 8th, Skilling counsel Daniel Petrocelli followed up by asking Fastow during cross-examination about the sentence that he had agreed to under his plea deal:

Q. Okay. And you said you have to go to jail for 10 years; right?

A. Well, my sentence is for 10 years. I could potentially have time off for good behavior. [. . .]

Q. Okay. And the reason why you just answered my question in the way you did is because you want to communicate to the jury that Mr. Skilling is a criminal along with you, correct?

A. No, Mr. Petrocelli. I’m just trying to answer the questions honestly. My outcome is already determined.

Q. Well, not —

A. I’ll be sentenced to ten years as far as I understand. It doesn’t matter — my sentence isn’t affected by whether Mr. Skilling is convicted or not.

Then, on re-direct examination by Hueston on March 13th, Fastow testified as follows:

Q. And as a result of your pledge to cooperate, did you agree to plead guilty to a 10-year minimum sentence of imprisonment?

A. A 10-year maximum imprisonment.

Q. And what is the minimum amount of time that that plea agreement calls for?

A. It calls for a 10-year sentence.

Q. So after January 14th, can your cooperation lower that 10 years?

A. My understanding is that I will be sentenced to 10 years. The Judge ultimately has a discretion; but in my plea agreement, I agreed to the 10-year sentence.

Later that same day, Hueston asked Fastow about the suggestion made during cross-examination that Fastow had forged the key Global Galactic agreement between Fastow and former Enron chief accountant, Richard Causey:

Q. And after all this time, you found and turned over the document to the FBI, you remembered, late May or June; is that right?

A. I believe that’s correct, yes.

Q. And you turned it over because you were cooperating?

A. Yes, sir.

Q. And this is months after, six months after, you enter your plea of guilty; is that right?

A. Approximately, yes, sir.

Q. And can this document lower your sentence now, under your understanding?

A. My understanding is, no.

Q. And if, as the defense was suggesting, you were just falsely creating this document, wouldn’t it have been better to do so before you entered a plea of guilty, when you were bargaining with the government?

A. Well, one could argue that. [. . .]

Q. Mr. Fastow, if as the defense suggests, you’re on some sort of mission to say or do anything to convict Jeff Skilling, might you have been tempted to just add a couple more initials to that Global Galactic document?

A. Sir, I have no incentive to add any initials. My incentive is to be truthful. If I’m not truthful, I could go to prison for life. By making a document more compelling, I can’t lower my sentence.

Q. By trying to do that, there’s only one thing you’re sentence would do; right?

A. I’m sorry?

Q. If you tried to alter a document or tell a lie, there’s only one direction that sentence can go?

A. That’s correct. That would be a lie. That means my sentence would go up, potentially, to a life sentence.

Want to make a bet that the Task Force prosecutors did not inform Judge Hoyt today during Fastow’s sentencing hearing that Fastow and the Task Force had previously represented to the Lay-Skilling jury that Fastow’s testimony was more credible because he had agreed to a minimum ten-year sentence?