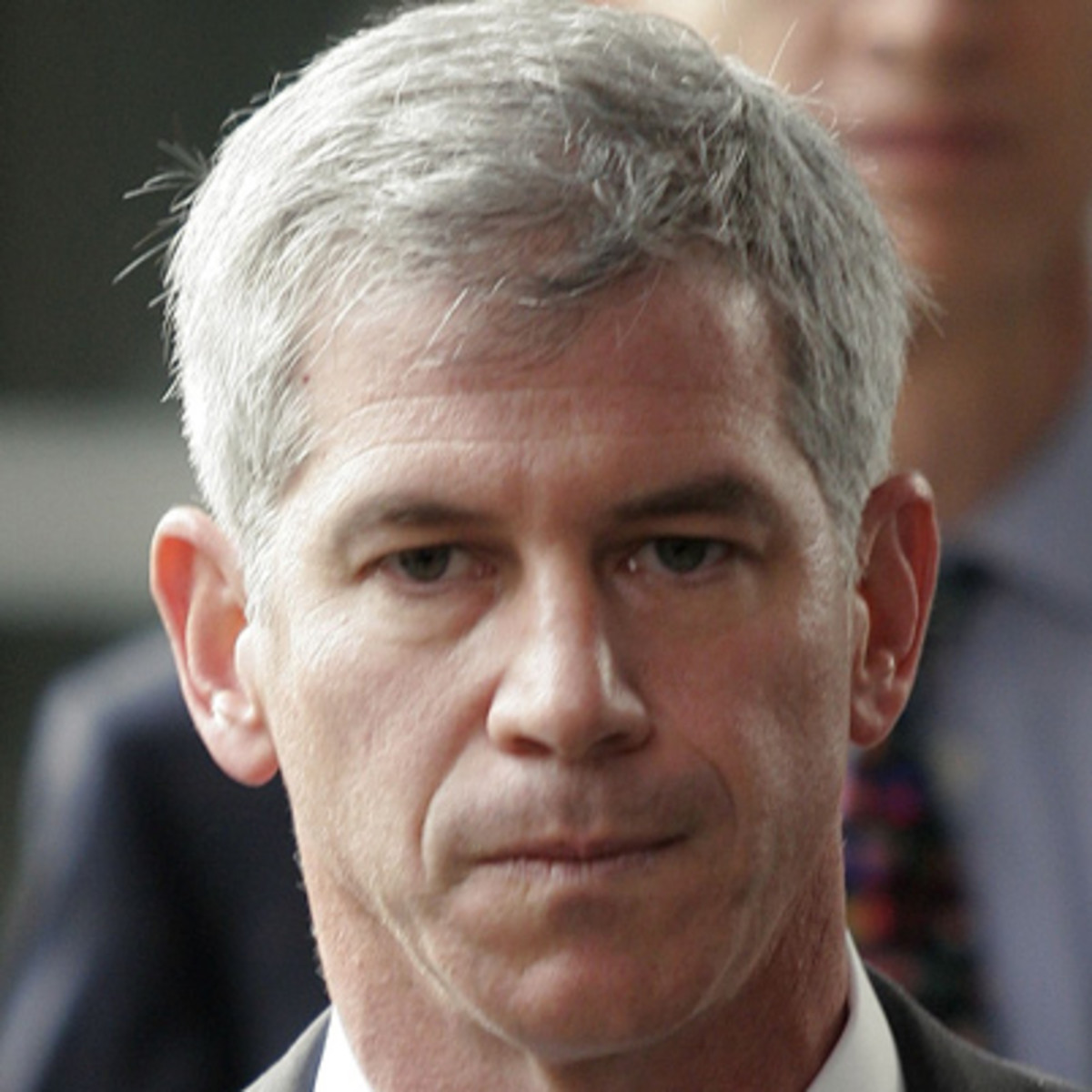

This Kristin Hays-Tom Fowler/Chronicle article picks up on an aspect of the six-year sentence assessed to former Enron CFO Andrew Fastow earlier this week that has largely been ignored in the media but noted earlier here.

This Kristin Hays-Tom Fowler/Chronicle article picks up on an aspect of the six-year sentence assessed to former Enron CFO Andrew Fastow earlier this week that has largely been ignored in the media but noted earlier here.

The Enron Task Force elicited testimony from Fastow during the Lay-Skilling trial that represented to the jury that Fastow was a more credible witness because he had agreed to a minimum ten-year prison sentence and, thus, had no incentive to lie.

As we know now, Fastow had not really agreed to anything of the sort and, in fact, successfully petitioned U.S. District Judge Ken Hoyt for a lighter sentence. The article quotes several experts — including former Enron Task Force director Andrew Weissmann — who express surprise that the Task Force did not attempt to require Fastow to serve a minimum of ten years.

Although interesting, the article fails to address the most troubling aspect of the Fastow sentencing hearing — that is, the apparent failure of any of the attorneys involved to inform Judge Hoyt about how the Lay-Skilling jury was misled by Fastow’s testimony.

When Judge Hoyt finds out about that he was not informed about that, my sense is that he is not going to be pleased.

The public reaction to the Fastow sentence has been fascinating and reflects the dubious nature of the Justice Department’s regulation of business-through-criminalization policy.

Viewed in a vacuum, the Fastow sentence is reasonably fair. Fastow effectively embezzled millions from Enron and ruined the careers of several other Enron executives who he induced to participate in the embezzlement. Six years is a harsh sentence, so Fastow is certainly not getting off lightly.

However, the Fastow sentence was not handed down in a vacuum.

Not only did Fastow and the Task Force prosecutors mislead the jury in order to convict Lay and Skilling, they trampled justice by needlessly ruining the careers of the four Merrill Lynch executives in the Nigerian Barge case and they are currently doing the same thing to the three U.K. bankers in the NatWest Three case.

There is simply no way to reconcile Fastow’s sentence with the six-year sentence handed down to Jamie Olis — who did not steal anything and refused to tell lies about others — or the seven-year sentence of former Enron chief accountant Richard Causey, who also did not steal anything and who has not testified against anybody.

The death of Ken Lay from defending himself against a weak and unjust case, as well as the effective life sentence likely faced by Jeff Skilling, further underscore the confusing message conveyed by the Fastow sentence.

As Larry Ribstein has repeatedly observed, criminal cases involving business executives have become a sort of lottery, incrementally undermining the principles of justice and respect for the rule of law upon which the success of American society is largely based.

If we lose respect for those principles, then “do you really think you could stand upright in the winds [of abusive state power] that would blow then?

U.S. District Judge Sim Lake resentenced Jamie Olis to six years in prison this afternoon (Olis has already served about 2.5 years in prison) in the latest chapter of

U.S. District Judge Sim Lake resentenced Jamie Olis to six years in prison this afternoon (Olis has already served about 2.5 years in prison) in the latest chapter of