As Ashby Jones and Peter Henning noted on Friday, lawyers for Jeff Skilling filed his appellant’s brief this past Friday along with a motion requesting that the Fifth Circuit Court of Appeals waive length-of-brief rules under the special circumstances of Skilling’s appeal.

As Ashby Jones and Peter Henning noted on Friday, lawyers for Jeff Skilling filed his appellant’s brief this past Friday along with a motion requesting that the Fifth Circuit Court of Appeals waive length-of-brief rules under the special circumstances of Skilling’s appeal.

Inasmuch as the brief is a 240-page tome, my sense is that it will probably be modified slightly to include tables of contents and authorities when the final version is filed after the Fifth Circuit rules on the the length-of-brief motion

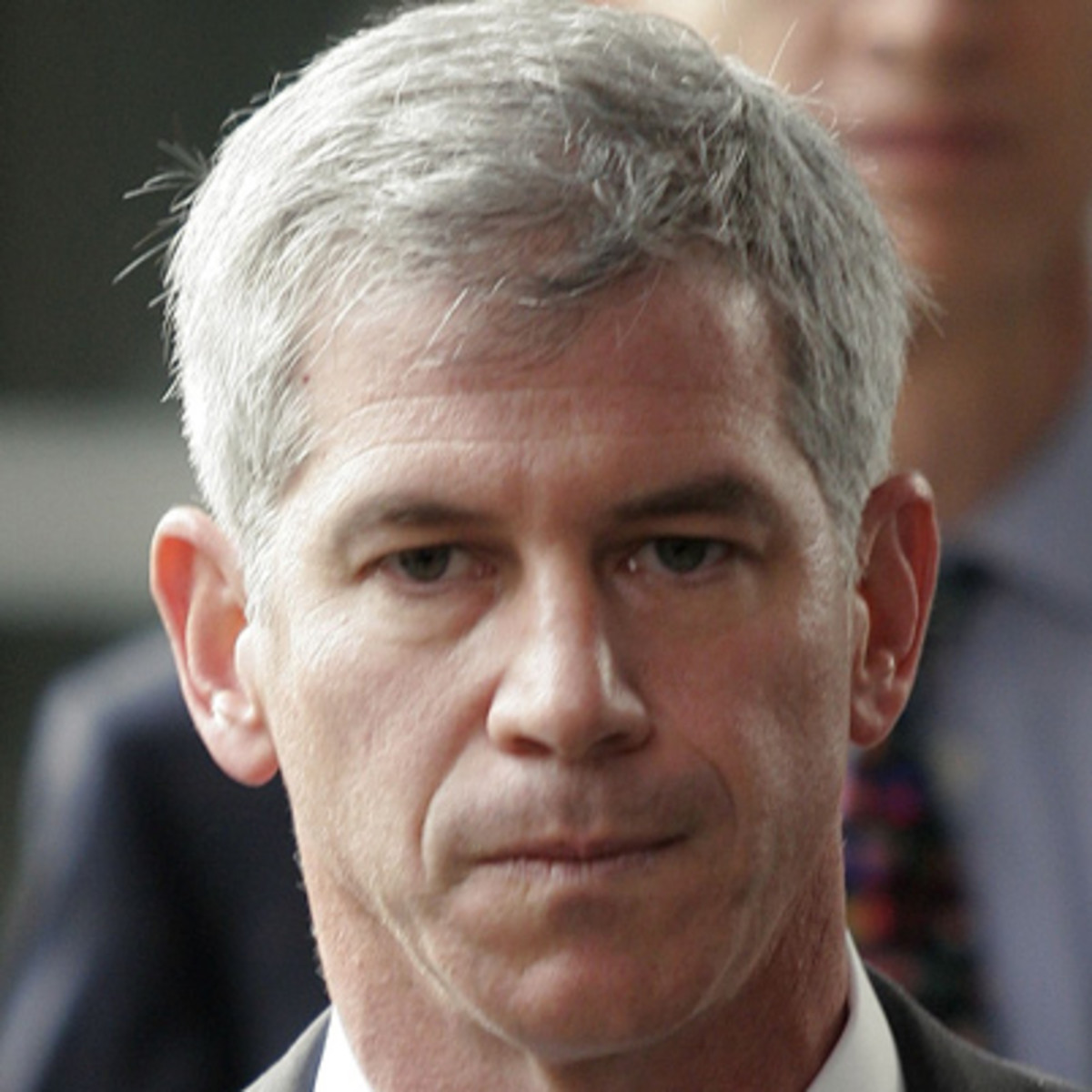

I read the entire brief while watching football over the weekend and it is brilliant. The brief is extremely well-written and organized, and eschews much of the technical legal jargon that often makes appellate briefs a chore to read. It would be extremely difficult to read this brief objectively and come to the conclusion that Jeff Skilling has not been the victim of a gross miscarriage of justice.

The first statement of the brief — the usually mundane statement advising the appellate court whether the appellant believes that oral argument would be helpful to the court — Skilling’s appellate team crafted the best such statement that I’ve ever read:

Defendant-appellant Jeffrey Skilling requests oral argument. This case is perhaps the most prominent and publicized white-collar case ever prosecuted.

But with certainty, it is the most misunderstood case, enveloped from the outset by perceptions and myths that bear little resemblance to the actual facts.

Almost everyone believes, for instance, that Skilling was indicted, tried, and convicted for causing the 2001 bankruptcy of Enron Corporation and its devastating effects on thousands of Enron employees and shareholders. As the government itself conceded, however, the case against Skilling had nothing to do with Enron’s collapse.

Profound, inherent weaknesses in the government’s case — not just gaps in its evidentiary proof, but doubts about its basic theories of criminality — motivated the government to resort to novel and incorrect legal theories, demand truncated and unfair trial procedures, and use coercive and abusive tactics.

Skilling submits that oral argument is essential to assist the Courtís understanding of the remarkable record in this case, including the multiplicity of substantial legal and procedural errors that have put Skilling in prison for 24 years not only for crimes that he did not commit, but for acts of business judgment that are not crimes at all.

Following that statement is an 11-page introduction, which — if you don’t have time to read the entire brief — is an excellent overview of the arguments presented. My favorite parts of the brief are as follows:

The Statement of the Case (pp. 15-59). This is a marvelously clear description of Enron’s business and the superficiality of the evidence that the Enron Task Force presented at trial against Skilling. In discussing Enron with hundreds of folks over the past several years, I understand how few people really understood that Enron was an innovative and successful business before its demise. Fewer still understood the shallowness of the Task Force’s case against Skilling. This section of the brief takes on those widely-held misconceptions and dispenses with them cogently.

The Change of Venue Section (pp. 122-175). Given the venomous environment in Houston regarding all things related to Enron, U.S. District Judge Sim Lake’s refusal to grant Skilling’s motion to change the venue of the trial has always struck me as odd. Skilling’s brief provides truly shocking information (heretofore not public) about the enormous bias against Skilling expressed in the answers to the juror questionairres of the jurors who ended up on Skilling’s jury! Also provided in this section is heretofore non-public information on Judge Lake’s questionable refusal to grant Skilling’s proposed multiple strikes for cause on a large number of the jurors who who had expressed clear bias against Skilling and Lay. As the brief notes, if there was ever a trial that called for a change of venue, Lay-Skilling was the one.

The Prosecutorial Misconduct Section (pp. 175-206). The subject of this section has been a common topic on this blog, but this section provides additional unknown evidence of the Task Force’s abusive tactics in prosecuting Skilling and other Enron executives. Moreover, the brief sums up brilliantly the prejudicial impact of the Task Force’s threats against witnesses who would have provided exculpatory testimony for Skilling (all record citations contained in the brief are excluded here):

At trial, the severe imbalance in witness access was obvious.

The Task Force’s case consisted mostly of cooperators from Enron’s senior management,people who worked with Skilling at Enron and who were his friends, including some of his closest friends. With plea or non-prosecution agreements with the Task Force, these witnesses were under the Task Force’s complete domination and control. They were obligated to testify, contractually bound to admit guilt and support the allegations against Skilling, and their ultimate fate rested in the “sole and exclusive discretion” of the Task Force. None of them would meet with Skilling or his counsel. At least two (Rice and Belden) — and probably all of them — were clearly ordered not to.

In contrast, most of Skilling’s key defense witnesses never took the stand. Specifically, Skilling sought to call David Duncan of Arthur Andersen and seven Enron executives: Greg Whalley, Rick Buy, Lou Pai, Jeff McMahon, Georgeanne Hodges, Janet Dietrich, and Joe Hirko. Each possessed critical exculpatory evidence, and would have directly refuted testimony given by Task Force cooperators. Yet all eight invoked the Fifth Amendment, fearing Task Force reprisals. Hoping to overcome this, Skilling asked the Task Force to immunize them, as it did for Ben Glisan (its own witness). The Task Force declined, thereby ensuring that vital exculpatory testimony never saw the light of day.

Without these (and many other) key witnesses, the defendants were forced to rely primarily on their own testimony. Roughly two-thirds of the defense case consisted of Skilling and Lay’s testimony; the remainder was a patchwork of character witnesses, experts, and others — anyone courageous enough to testify. Most could offer relatively narrow testimony on limited issues. Besides Skilling and Lay, only two senior executives testified for the defense, and neither was deeply involved in many transactions at issue.

Compounding the prejudice, the Task Force argued in closing that Skilling’s defense was not credible because it did not square with the testimony of many witnesses. By intimidating witnesses into silence and then refusing to immunize them — knowing they would give testimony favorable to the defense — it was the Task Force that prevented witnesses from corroborating Skilling. U.S. v. Golding, 168 F.3d 700, 702-05 (4th Cir. 1999) (“The government did not stop with the threat. Instead, the prosecutor further abused her power by using the very situation she had created against the defendant in closing argument.”). Skilling, meanwhile, could not explain to the jury why his best witnesses were missing, because the district court explicitly prohibited him from introducing any evidence of the Task Force’s threats and other misconduct.

The prejudice was irreparable. It obstructed Skilling’s preparations before trial, distorted the presentation of evidence at trial, and affected the outcome. Gregory, 369 F.2d at 188-89 (“A criminal trial is a quest for truth. That quest will more often be successful if both sides have an equal opportunity to interview the persons who have the information from which the truth may be determined.”).

As if on cue, even before the ink on the Skilling brief was dry, some of the more vitriolic members of the mob that lynched Skilling were already dismissing it without so much as a smidgen of analysis. But my bet is that a fair review of this brief will leave most readers shocked over the weakness of the case against Skilling and the government’s ruthless tactics in pursuing a conviction despite that weakness.

The popular myth of the mob is that Enron was a house of cards that was propped up by a conspiracy of greedy executives who told lies to trusting but unknowing investors.

The truth is that Enron was simply a highly-leveraged, trust-based business with a relatively low credit rating and a booming trading operation that got caught in a liquidity crunch. That liquidity crisis occurred when the credit and equity markets became spooked by a variety of factors in late October, 2001, including revelations about Fastow’s embezzlement of millions and the volatility in markets after the September 11, 2001 attacks on New York and Washington, D.C.

As I’ve noted many times over the years, Fastow’s embezzlement from Enron is a crime, but Enron’s unfortunate demise is not, nor should it be.

Beyond the shattered lives and families, the real tragedy here is that an angry mob convicted Jeff Skilling, trampling the rule of law and the administration of justice along the way.

In truth, none of us would be able to survive, as Thomas More reminds us, “in the winds that blow” from the exercise of the government’s overwhelming prosecutorial power in response to the demands of the mob.

I continue to hope that Jeff Skilling’s unjust conviction and sentence are reversed on appeal. Not only for his and his family’s benefit, but also for ours.

Like this:

Like Loading...

The big Enron-related news this week was the U.S. Supreme Court’s refusal to hear the appeal of the Fifth Circuit’s decision to dismiss securities fraud claims against several of Enron’s banks (Ted Frank explains the decision).

The big Enron-related news this week was the U.S. Supreme Court’s refusal to hear the appeal of the Fifth Circuit’s decision to dismiss securities fraud claims against several of Enron’s banks (Ted Frank explains the decision).