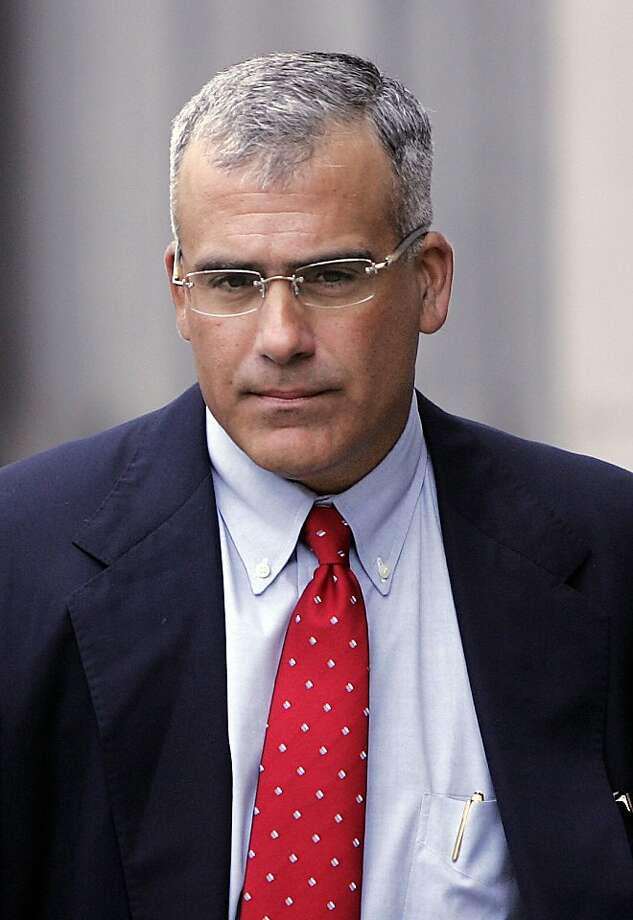

With the Conrad Black trial winding down in Chicago, it’s about time for another dubious prosecution of a businessman, this time former Brocade CEO Greg Reyes, who is the first executive to be prosecuted for fraud in connection with backdating stock options.

With the Conrad Black trial winding down in Chicago, it’s about time for another dubious prosecution of a businessman, this time former Brocade CEO Greg Reyes, who is the first executive to be prosecuted for fraud in connection with backdating stock options.

Larry Ribstein has been following the case since the start and has excellent analysis of the selective nature of the prosecution.

Here is Steve Stecklow’s WSJ article on the trial.

Given the widespread nature of backdating, there are probably more criminal defense attorneys watching this trial than any other single prosecution of a businessperson over the the past five years. If a blogger pops up to cover the trial, I’ll pass it along.

I watched this case from the beginning. I am shocked and disturbed at the outcome of this Reyes case.

For those that don’t know, stock options plans, since at least 1980 have been constructed so that when new hires come on board they are granted options at the lowest price of that quarter, backdated to their start date. This is standard procedure, to avoid the paperwork of granting options every day. Additionally, for strategic new hires, a special case of this is established so that in the offer letter his actual price of the shares is stated to get him to join (the regular people don’t get this, they are just told they are getting the lowest price of the quarter set at the next board meeting- whereas the key personnel it is more in writing to get them to join). Then when the day comes to file the paperwork with the IRS, somebody in HR or Finance uses a stock options software package that spits out paperwork granting the shares on that trading day (here is where the Feds say the fraud occurred #1), and then a stack of papers arrives on the CEOs desk to sign and he signs this paperwork with erroneous document creation dates (this is where feds say fraud occurred #2).

This is what Reyes was convicted for. He is only 44 years old and has likely seen this procedure ongoing at every company he has ever worked for. To call this practice criminal just due to the widespread nature of it is really a stretch.

Anyway in the closing arguments the DOJ lied to the jury stating that the practice of backdating these documents was a clandestine act hidden from the Finance dept- “the CFO didn’t know a thing” about this according to prosecutors, and then a week later the DOJ indicted the CFO, this contradicting their own closing arguments.

I am sick from this indictment and conviction.